Introduction

Contractors often seek protection against the risk of financial damages and delays as a result of a loss event during construction. A loss event during construction can also pose a serious risk for owners in that it can possibly delay commercial operations and result in a loss of income. The insurance industry provides ways to insure against these risks in the form of Builder’s Risk and Delay in Start-Up (DSU) Insurance products aimed at contractors and owners respectively.

These types of policies aim to mitigate the financial risk associated with the impact of a loss event and typically provide coverage for:

- Repair and mitigation expenses related to a loss event

- Extra expenses incurred to maintain the scheduled progress

- Loss of income

The loss event and associated repairs may cause the construction project completion date and subsequent start of commercial operations to be delayed. When an insurance claim is submitted the impact of the loss event on the completion of the project needs to be determined to calculate the financial loss suffered.

As a result of the frequent occurrence of delays in construction projects an extensive body of knowledge on how to measure delay developed over the years. Despite the wealth of information available on delay analysis limited literature that specifically deals with the analysis of delay in the context of Builder’s Risk and DSU insurance is in existence.

The aim of this article is to address this knowledge gap by considering what the most accurate approach would be to measure the impact of delay in builder’s risk and DSU insurance claims.

Approach

Before considering how delays covered by these types of policies should be measured it is necessary to understand the mechanics of Builder’s Risk /DSU insurance coverage. This was done by studying typical policy language, followed by a review of the limited literature available on the analysis of delay in builder’s risk and DSU insurance claims.

The information uncovered during the literature review was utilized in considering the most effective and accurate approach to analyze delays resulting from a loss event.

Builder’s Risk And Delay In Start-up Insurance

History

Construction projects are exposed to a myriad of risks. Contractors would in most cases take on the risk of unforeseen events like fires, theft, water damage, and accidents. Builder’s risk insurance had its origin in the late 19th century with a hybrid policy combining aspects of property insurance with inland marine coverage to offer risk mitigation to the contractor for certain unforeseen loss events. Over the years it evolved into Builder’s Risk insurance as we know it today.1

The origins of Delay in Start-Up (DSU) insurance is difficult to trace. Delay in Start-Up insurance is sometimes referred to as Advance Loss of Profits Insurance (ALOP). It appears that this type of insurance started in the early 1980s and first emerged as a topic at the IMAI Insurance Conference in 1982 in Montreux.2 Some other sources also makes reference of the emergence of DSU Insurance policies in the 1980.3

Builder’s Risk And DSU Literature

Some degree of guidance on Builder’s Risk and DSU insurance claims is provided by the insurance industry. The following organizations appear to be the most prominent in this regard:

- IMIA, a network of experts in Engineering Insurance from around the world that acts as a discussion forum and produces papers on topics of Engineering Insurance. 4

- LEG, a consultative body for insurers of engineering class risks produces various industry recognized papers, coverage clauses, and guidance notes. Membership is drawn from the various insurance and re-insurance companies that are actively involved in underwriting risks within the engineering classes. 5

IMIA and LEG collectively produced a practice note on Delay in Start Up Insurance. The 2-page practice note generally deals with insurance related matters like coverage, indemnity, and deductibles but does not discuss methods to be utilized to determine the delay to completion as a result of a loss event.6

An article appearing on the Lexology website (the most comprehensive source of international legal updates, analysis, and insights), titled: Delay in Start Up insurance and Delay Analysis Techniques, reviews the common construction delay analysis methods when applied in DSU claims.7 The article utilizes standard DSU policy wording to review the common construction delay analysis methods to determine the most suitable delay analysis method. The author of the article favors the Collapsed As-Built delay analysis method as the method that is most likely to yield the most accurate results.

The world’s second largest reinsurer, Swiss Reinsurance Company Ltd, produced a brochure8 to assist underwriters and the parties involved in large construction projects to provide some fundamentals for Builder’s Risk and DSU insurance claims. This comprehensive brochure provides information on periods and dates, progress monitoring, risk evaluation, claim handling, and typical problem areas. The brochure does not directly discuss methods of delay analysis but provides very useful information on how the overlap of insured and un-insured delays should be dealt with.

Influence Of Policy Terms On Delay Analysis

Policies would typically include two specific terms directly relating to the delay caused by the loss event: Period of Restoration and Period of Delay. It is important to distinguish between these two terms.

Period of Restoration

Wording may vary but the Period of Restoration is commonly defined as the period required to execute repairs as a result of the loss event. It starts immediately after the loss event and ends when all repairs related to the loss event are completed.

Period of Delay

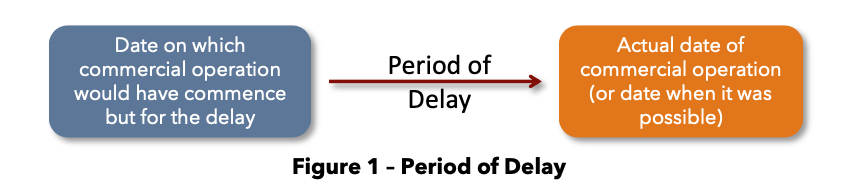

The Period of Delay is in essence the actual delay to project completion as a result of the loss event. The starting point of the period of delay is the date when commercial operation would have commenced if the loss event did not occur and ends with the actual commencement of commercial operation.

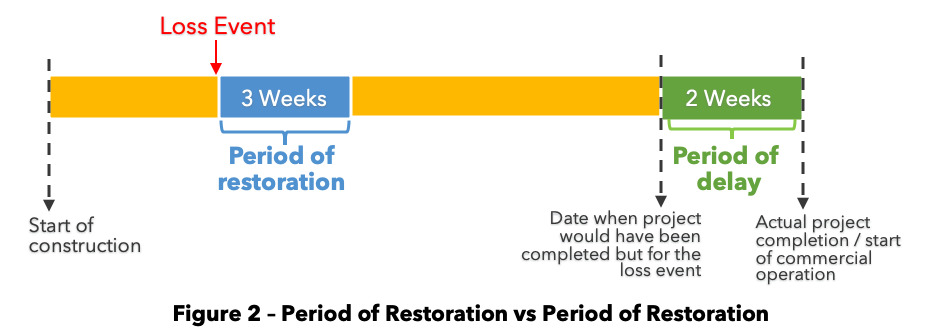

The loss event and the consequential Period of Restoration would in many cases cause a delay to completion and the start of commercial operation. The duration of this delay is the Period of Delay. Figure 2 highlights the difference between the Period of Restoration and the Period of Delay. The duration of the Period of Restoration is dependent on the time required to complete all repair activities. The Period of Delay is determined by the impact of the restoration on critical path activities (if the duration of critical path activities is extended, project completion will be delayed) and whether acceleration has taken place.

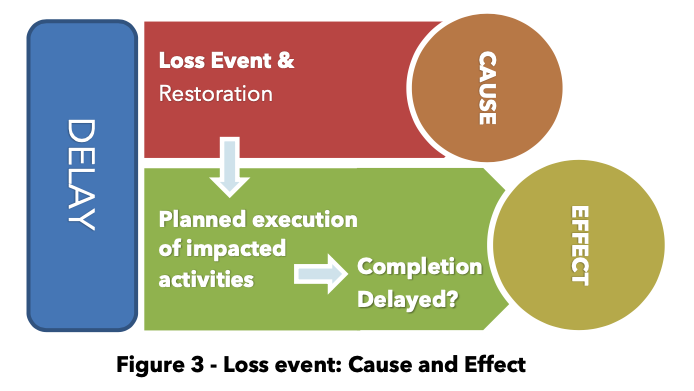

The relationship between the two terms can be further explained by looking at the delay analysis concept of cause and effect. The loss event and the subsequent restoration (the cause) impact the planned execution of the project activities and might delay the completion of the project (the effect). In other words, the period of restoration will impact the planned completion of construction and the start of commercial operation.

Measuring Delay

Complexities

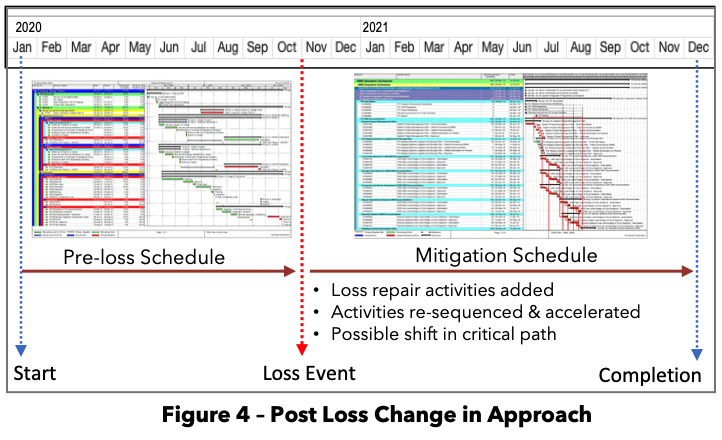

The occurrence of a loss event has several consequences that influence the execution of a construction project. When a loss occurs the first priority is to complete repairs as rapidly as possible to limit the impact on the planned completion of the project. The original construction approach and sequencing of work depicted in the pre-loss schedule is no longer viable because new repair and restoration activities are introduced. Activities are re-sequenced and accelerated to mitigate the impact of the loss event. The pre-loss schedule will have to be replaced by a new schedule that incorporates the repair and mitigation activities. It is likely that the critical path in the pre-loss schedule and the mitigation schedule would differ. Activities that were critical in the pre-loss schedule may not be critical any more in the mitigation schedule.

Steps In The Analysis Process

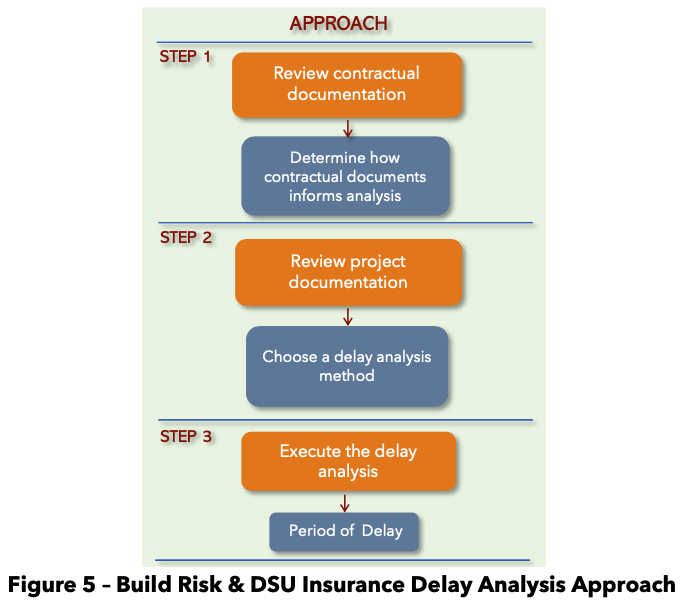

Given the complexities involved in these types of claims a structured analysis approached is recommended. The following steps can be followed to analyze the delay and ultimately determine the period of delay as a result of the loss event:

Step 1 – Review Of Contracual Documents

The contractual document review should include documents that may contain information that will influence the analysis of the delay. The policy document is of importance as it may contain information that may influence the analysis. One of the priorities in the review of the policy document is to determine whether a specific delay analysis method is prescribed by the policy. It is very likely that the policy will not directly prescribe a specific analysis method.

If no method is prescribed the policy language might provide some guidance on the most suitable method to utilize. Policies would typically describe coverage by including wording along the lines of: the insured will be indemnified for the cost associated with the loss event and the loss of earnings that would have been arrived from the project but for the delay. The phrase: “but for the delay” can possibly provide some guidance to what an appropriate method of delay analysis might be.

The American Association of Cost Engineers (AACE) Forensic Schedule Analysis Practice Note (29R-03) states that “.., the subtractive modeling methods are one of the only tools to identify and quantify the overall extent to which the contractor’s actual performance would have resulted in a project duration shorter than the baseline schedule, but for the delays.” The AACE 29R-03 includes two subtractive modeling methods, MIP 3.8 and MIP 3.9, these methods are commonly referred to as Collapsed As-Built methods of analysis. It appears that the Collapsed As-Built method may the most appropriate of the common delay analysis methods if the policy includes the typical “but for” language.

In addition to the method of analysis, the policy review should also consider the implication of policy terms like Basis of Indemnity, Date of Completion, Period of Delay, Period of Restoration, and other terms that may influence the measurement of delay. The review should also determine whether the policy indicates how concurrent insured and uninsured delays should be dealt with. This can for example occur when the loss event repairs take place at the same time or overlap with another delay that is not indemnified by the policy, like the unavailability of material due to orders not being placed timeously.

Other contractual documentation like the construction agreement can also be of value to provide context for the analysis process.

Step 2 – Choose A Delay Analysis Method

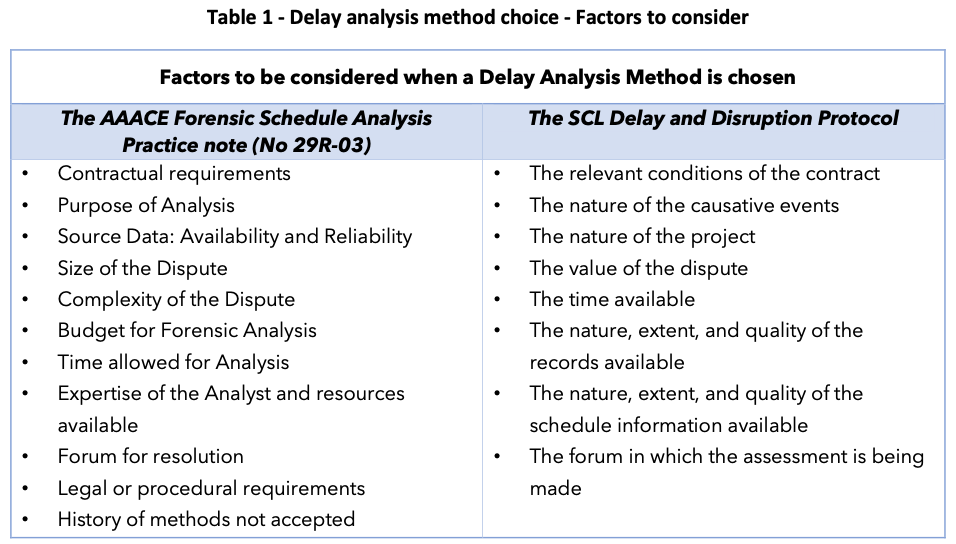

Several factors can influence the choice of a delay analysis method. The Forensic Schedule Analysis Practice note (No 29R-03) published by the American Association for the Advancement of Cost Engineering International, provides a list of factors to be considered when a delay analysis method is chosen. The UK Society of Construction Law’s Delay and Disruption Protocol also provides factors that will influence the delay analysis method to be utilized:

Perhaps the most significant of these factors is the availability of the relevant information (source data and records) to execute a specific method. If the policy indemnifies the insured for the loss of income that would have been arrived from the project but for the delay the Collapsed As-Built method may be the most appropriate choice of method. To successfully apply the Collapsed As-Built method it is essential that the following information is available:

- An accurate logic-linked As-Built Schedule

- Detailed information on Repair Activities

A logic-linked As-Built Schedule is very seldom available for projects. If a Logic logic-linked As- Built Schedule is not available, logic can be introduced to the As-Built Schedule but this can be a very complex and time consuming process that is likely to be very costly. A further disadvantage is that the updated As-Built Schedule prepared by the analyst will not reflect the contractor’s logic but rather the logic of the analyst. As a result of these challenges, one or more of the other delay analysis methods may in some cases be a better choice.

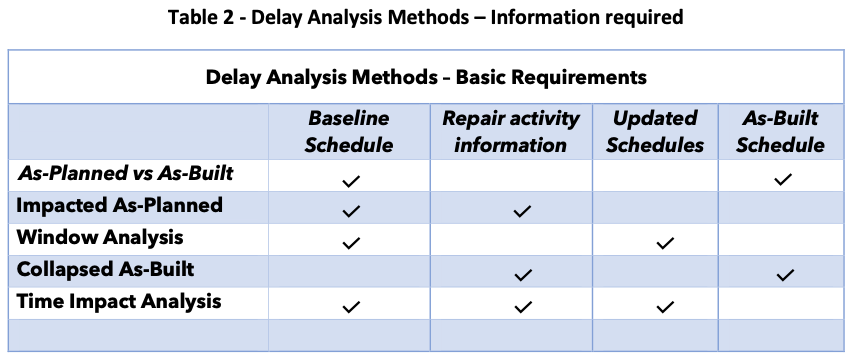

The information available should be reviewed to determine which of the industry recognized delay analysis methods can be applied. The basic requirements to execute a specific delay analysis method are summarized below:

Step 3 – Execute The Analysis

The main objective of delay analysis in Builder’s Risk and DSU insurance claims is to determine the period of delay that resulted from the occurrence of the loss event. The period of delay is typically the time period between the date when commercial operation would have commenced but for the delay and the actual date of the commencement of commercial operation. The actual date of commencement of commercial operation should not be difficult to determine but the date when commercial operation would have commenced if the loss event did not occur is more complicated to establish. If the policy language calls for a subtractive analysis and a logic linked As-Built Schedule is available a Collapsed As-Built analysis is a good choice of method to fulfill this objective. The following is a high-level summary of the steps required to execute the Collapsed As-Built analysis:

- Remove the repair activities and the effect of the repair activities on related activities from the logic-linked As-Built Schedule.

- Identify concurrent delays and pacing delays.

- Eliminate the impact of concurrent delays and pacing.

- Re-calculate the completion date.

If executed correctly, the re-calculated completion date of the collapsed schedule would constitute the date when commercial operation would have commenced if the loss event did not occur. To ensure accurate results it is critical that concurrent delays and pacing should be correctly considered. Concurrent delays in this context refer to the simultaneous occurrence or the overlap of insured delays and uninsured delays. To address concurrency, the policy should be consulted to determine whether any guidance on how to treat concurrent delays is provided. If not, the insurance industry and construction industry guidance literature can be consulted for assistance.

Pacing occurs when a decision is made by the contractor to slow the progress of other activities taking place at the same time as the delay created by the loss event. This happens very often in Builder’s Risk and DSU Insurance claims, especially when the loss event is of such significance that it will in all likelihood delay project completion. In this scenario, the loss event repairs will be critical. The most sensible approach to minimize the impact on project completion will be to focus efforts on the loss event repair activities and not on other activities that will no longer dictate the completion date. Each identified pacing delay should be considered by determining whether sufficient resources could have been utilized to complete the activity within its planned duration if it was required. If it was realistically possible to do so the effect of the pacing delay should be removed from the collapsed schedule.

If a logic-linked as-built schedule is not available another delay analysis method or a combination of methods can be employed to determine when the project would have been completed but for the loss event.

The final step in the process to determine the period of delay is to measure the time period between the date when the project would have been completed but for the loss event and the actual date of project completion. This duration is the period of delay that resulted from the loss event.

Conclusion

Although the objective of delay analysis in Builder’s Risk/ DSU Insurance claims and construction contract claims is the same there are some noteworthy differences. Where the construction agreement influences the analysis in construction contract claims the insurance policy fulfills this role in Builder’s Risk/ DSU Insurance claims. The extensive body of knowledge on delay analysis developed for construction contract claims can be successfully applied in the context of Builder’s Risk/ DSU Insurance claims if the differences are taken into account in the analysis process.

References

- https://buildersrisk.net/understanding-builders-risk-insurance-ebook/#dos

- https://www.imia.com/wp-content/uploads/2013/05/New-Development-in-Advance-Loss-of-Profits-Insurance-WGP-06_53-96.pdf

- https://www.jlta.com.au/docs/Construction_Whitepaper_201306.pdf?201507190539

- https://www.imia.com/about-imia/

- https://www.londonengineeringgroup.com/resource-library

- https://www.imia.com/wp-content/uploads/2013/10/LEG-DSU-An-Overview- 1358955726.pdf

- https://www.lexology.com/library/detail.aspx?g=814a2f33-9e51-4a0d-8e9e- 432c550c8940

- https://www.swissre.com/dam/jcr:b76d1bbf-2d0b-47f1-911a- 509232761aaf/pub_delay_in_startup_insurance_en.pdf